The Central Bank of Nigeria (CBN), in conjunction with the Nigeria Inter-Bank Settlement System Plc (NIBSS), recently introduced the card scheme known as AFRIGO. In order to enable cardholders to use their payment cards to make purchases and access cash at businesses around the world, payment networks and financial institutions form a system known as a card scheme.

The widely used card schemes are Visa, Mastercard, American Express, and Discover. These schemes develop standards and processes for card issuance, authorization, and security, among other things, to ensure a simple and secure experience for both cardholders and merchants. AFRIGO was launched on January 26, 2023 to unify all banking technologies in one card like UnionPay of China, RuPay of India, etc.

AFRIGO is believed to address the core difficulties by releasing foreign exchange reserves and promoting easy cross-border trade in the wake of the economic crisis in Nigeria. AFRIGO will address the drawbacks of previous card systems like Mastercard. The central bank of Nigeria (CBN) anticipates that AFRIGO will lessen the costs connected with the existing card systems and the requirement for keeping multiple cards by paying with local currency. The CBN believes that the data kept on each AFRIGO card will help to improve the economy by reducing laundering. Furthermore, through data sovereignty, AFRIGO seeks to shield customers from the monopolistic regulations of international card schemes.

Nigeria’s AFRIGO card scheme seeks to give both consumers and businesses a safe and practical way to make payments. In order to provide a widely used and effective form of electronic payment in place of conventional cash transactions, this system was created. To accommodate varied consumers’ demands, the Afrigo card scheme offers a range of payment methods, including debit cards, credit cards, and prepaid cards. Also, it makes it possible for users to transact both domestically and globally, which facilitates business operations and financial management for users. Afrigo’s overarching goal is to foster financial inclusion and spur economic development in Nigeria by offering a safe and convenient payment mechanism.

Ease of Commerce

The new domestic card initiative from the Central Bank of Nigeria (CBN) aims to improve small and medium-sized enterprises’ (SMEs) access to financial services by providing them with a more straightforward and safe method of handling payments. Safe payment methods increase client loyalty and buy their faith, helping businesses expand.

Foreign Exchange Control

AFRIGO will help balance the fluctuations in rate of exchange during trade. This domestic card scheme will help in seamless importation and exportation of products as well prevent the continual increase in commodity prices brought on by fluctuations in foreign exchange rates. Customers’ perception that they are being exploited has made it difficult for SMEs over time to gain their loyalty.

Financial Inclusion

The CBN considers that because many Nigerians don’t hold cards, they haven’t kept up with financial improvements throughout time. AFRIGO would promote the adoption of many cards in a less expensive and cashless way. This can support the expansion of SMEs by lowering their dependency on cash transactions and increasing their capacity to participate in the formal economy.

In essence, the AFRIGO card scheme intends to reduce expenses, gain data sovereignty, and address foreign exchange problems, all of which, when implemented, have a triple positive impact on the growth of SMEs. The CBN has accomplished a great deal and AFRIGO’s status as the continent’s first project of its kind is commendable. In general, the new domestic card from the CBN might give Nigerian SME growth the much-needed boost.

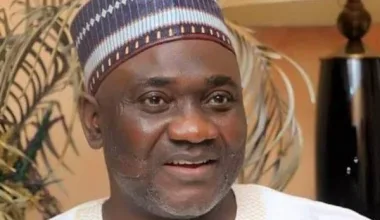

Emmanuel Otori has over 10 years of experience working with 100 start-ups and SMEs across Nigeria. He has worked on the Growth and Employment (GEM) Project of the World Bank, GiZ, Consulted for businesses at the Abuja Enterprise Agency, Novustack, Splitspot and NITDA. He is the Chief Executive Officer at Abuja Data School.